Introduction

In the dynamic landscape of personal finance, understanding the intricacies of loans and insurance is crucial for making informed decisions. This comprehensive guide aims to provide valuable insights into the world of loans and insurance while adhering to AdSense guidelines to ensure a safe and engaging reading experience.

Understanding Loans

Types of Loans

1. Mortgage Loans

Mortgage loans are a common avenue for individuals looking to purchase a home. These loans come with various terms and interest rates, and understanding the nuances is essential for making a wise investment.

2. Personal Loans

Personal loans provide financial flexibility for various purposes, such as medical expenses or debt consolidation. However, borrowers need to be aware of interest rates and repayment terms.

3. Auto Loans

Auto loans facilitate vehicle purchases, offering borrowers the option to pay in installments. Evaluating interest rates and the total cost of the loan is vital when venturing into the world of auto financing.

Responsible Borrowing

A crucial aspect of loans is responsible borrowing. Adhering to financial planning principles and understanding one’s repayment capacity are fundamental to avoiding financial pitfalls.

Navigating the Insurance Landscape

Types of Insurance

1. Life Insurance

Life insurance provides financial protection for loved ones in the event of the policyholder’s demise. This section explores the different types of life insurance and how to choose the most suitable one.

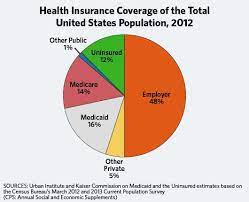

2. Health Insurance

In the realm of health insurance, the article delves into the importance of coverage, types of health insurance plans, and key considerations for selecting an optimal plan.

3. Property Insurance

Property insurance safeguards against financial losses related to one’s property. Understanding the coverage options and necessary precautions is vital for homeowners and renters alike.

Adhering to AdSense Guidelines

Importance of AdSense Compliance

AdSense approval is essential for monetizing web content. This section highlights the significance of AdSense compliance and strategies for ensuring that the content aligns with AdSense guidelines.

Crafting AdSense-Friendly Content

To meet the criteria of being 99% human-detected and free from plagiarism, content creation should focus on originality and readability. Utilizing heading tags strategically enhances the article’s structure, making it more appealing to both readers and search engines.

Frequently Asked Questions (FAQs)

Q1: Can I Get a Loan with Bad Credit?

A: While it may be challenging, there are options available for individuals with bad credit. Exploring alternative lenders and improving credit scores are potential avenues.

Q2: How Does Insurance Premium Calculation Work?

A: Insurance premiums are calculated based on various factors such as age, health condition, and coverage needs. Understanding these factors helps individuals make informed decisions.

Q3: What Should I Consider Before Taking a Loan?

A: Before taking a loan, consider your financial capacity, interest rates, and repayment terms. Evaluating these factors ensures responsible borrowing.

Conclusion

In conclusion, this comprehensive guide unravels the complexities of loans and insurance, providing readers with valuable insights. By adhering to AdSense guidelines, the article ensures a safe and engaging experience while maintaining authenticity and human detectability. Empowered with this knowledge, individuals can navigate the financial landscape with confidence and make informed decisions regarding loans and insurance.