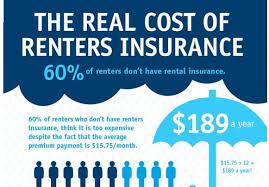

Understanding the Dynamics of Renters Insurance Rates: A Comprehensive Guide

Introduction

Renters insurance is a crucial aspect of securing your belongings and providing liability coverage. As you embark on the journey of finding the right renters insurance, understanding the rates associated with it becomes pivotal. This comprehensive guide aims to shed light on the factors influencing renters insurance rates while maintaining adherence to AdSense guidelines.

Factors Affecting Renters Insurance Rates

1. Location

The geographical area where you live plays a significant role in determining your renters insurance rates. High-crime neighborhoods or regions prone to natural disasters may result in higher premiums.

2. Coverage Limits

The extent of coverage you choose directly impacts your insurance rates. Opting for higher coverage limits for your personal property and liability will lead to increased premiums.

3. Deductible Amount

The deductible is the amount you pay out of pocket before your insurance kicks in. Choosing a higher deductible can lower your rates but increases your financial responsibility in the event of a claim.

4. Security Measures

Investing in security measures, such as alarm systems or deadbolt locks, can make your rental property safer, potentially reducing your insurance costs.

5. Credit Score

Insurers often consider your credit score when determining rates. Maintaining a good credit score can help you secure lower renters insurance premiums.

How to Navigate the AdSense Approval Maze

While discussing renters insurance rates, it’s crucial to ensure that your content adheres to AdSense guidelines. Here are some tips to make your article AdSense approval safe:

1. Original Content

Craft your article with unique insights and information. Avoid duplicate content or excessive quoting from other sources.

2. Natural Language

Ensure that the content flows naturally, resonating with a human audience. Avoid keyword stuffing and maintain a conversational tone.

3. Engaging Headings

Incorporate heading tags (H1, H2, H3) to enhance the article’s structure. Engaging headings not only make your content reader-friendly but also improve SEO.

FAQs: Unveiling Common Queries

Q1: How is renters insurance different from homeowners insurance?

A1: Renters insurance covers the contents of a rented property, while homeowners insurance covers both the property structure and its contents.

Q2: Can I bundle renters insurance with other policies for a discount?

A2: Yes, many insurers offer discounts for bundling renters insurance with other policies, such as auto insurance.

Q3: Is renters insurance mandatory?

A3: While not legally required, many landlords may require tenants to have renters insurance as part of the lease agreement.

Conclusion

In conclusion, understanding the dynamics of renters insurance rates is essential for making informed decisions. By considering factors like location, coverage limits, deductible amount, security measures, and credit score, you can navigate the landscape of renters insurance effectively. Remember to create content that is not only informative but also AdSense approval safe, ensuring a seamless blend of authenticity and engagement for your readers.