Health Insurance in New York

Health insurance is a critical component of financial planning and well-being, ensuring that individuals and families can access the healthcare they need without facing exorbitant costs. In New York, a diverse and dynamic state, understanding the intricacies of health insurance is essential for residents to make informed decisions about their coverage. This article aims to shed light on the key aspects of health insurance in New York, providing valuable information for those seeking comprehensive and affordable healthcare solutions.

1. The Importance of Health Insurance:

Healthcare costs can be overwhelming, and having the right insurance coverage is crucial for safeguarding against unexpected medical expenses. In New York, where the cost of living is relatively high, health insurance plays a pivotal role in ensuring that individuals have access to quality healthcare without compromising their financial stability.

2. Health Insurance Options in New York:

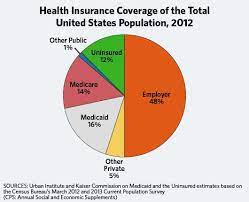

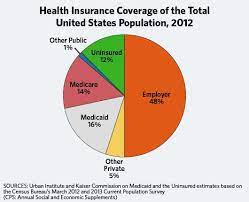

New York offers various health insurance options to cater to the diverse needs of its residents. Individuals and families can choose from employer-sponsored plans, government programs like Medicaid and Medicare, and private insurance plans available through the New York State of Health marketplace. Navigating these options requires a careful assessment of personal needs, budget considerations, and preferred healthcare providers.

3. The New York State of Health Marketplace:

The New York State of Health marketplace serves as a centralized platform where individuals and families can explore, compare, and purchase health insurance plans. It provides a range of coverage options, including Medicaid, Child Health Plus, Essential Plan, and Qualified Health Plans. Open enrollment periods are announced annually, during which individuals can enroll in or modify their health insurance coverage.

4. Medicaid and Medicare:

Medicaid and Medicare are government-funded programs designed to provide health coverage for specific demographics. Medicaid is targeted towards low-income individuals and families, while Medicare primarily serves individuals aged 65 and older. Understanding the eligibility criteria and benefits of these programs is essential for those who may qualify.

5. Employer-Sponsored Health Insurance:

Many New Yorkers receive health insurance coverage through their employers. Employer-sponsored plans vary in terms of coverage and cost, and employees should carefully review the options available to them during open enrollment periods. Additionally, individuals leaving their jobs may be eligible for continuation of coverage through COBRA (Consolidated Omnibus Budget Reconciliation Act) for a certain period.

6. Essential Plan:

The Essential Plan is a program specifically tailored for low-income individuals who do not qualify for Medicaid. It offers affordable coverage with low monthly premiums and out-of-pocket costs. Eligibility for the Essential Plan is determined based on income and household size.

Health insurance is a fundamental aspect of ensuring health and financial security in New York. With various options available, residents can find coverage that suits their individual needs. It is essential to stay informed about the different plans, eligibility criteria, and enrollment periods to make well-informed decisions. By navigating the landscape of health insurance in New York, individuals and families can protect their well-being while managing healthcare costs effectively.