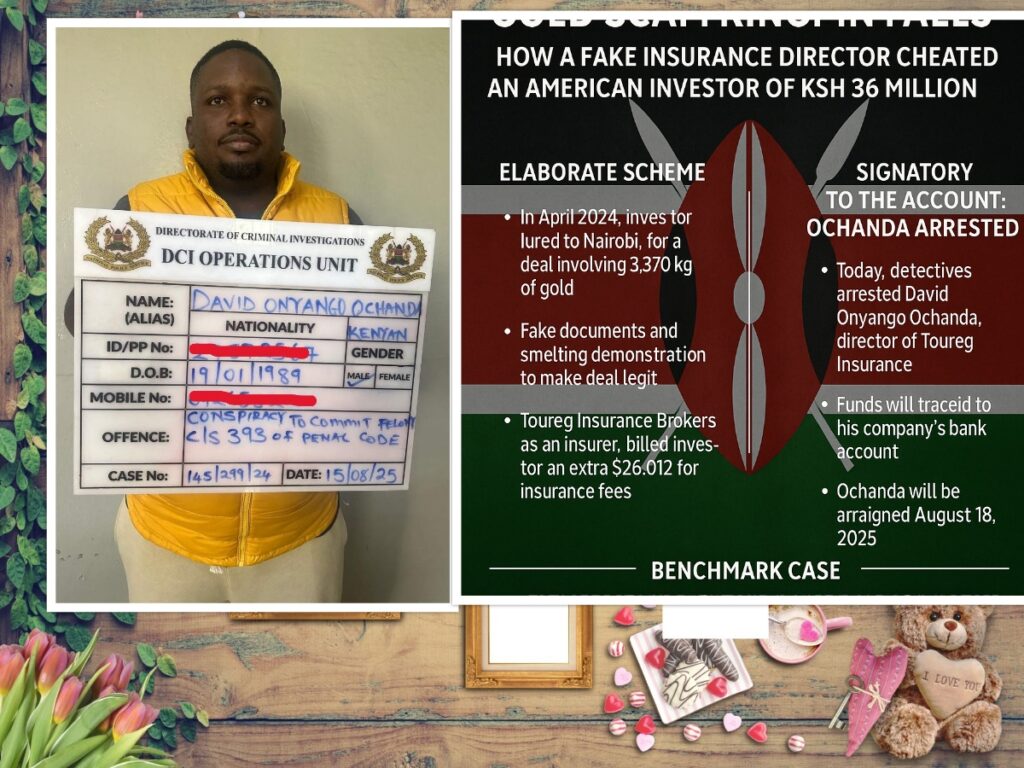

A man accused of masterminding a gold scam that swindled an American investor out of USD 225,968 (KSh 36 million) has been arrested in Nairobi after months of investigations.

Detectives from the Operations Support Unit (OSU) raided and apprehended David Onyango Ochanda, the director of Toureg Insurance Brokers Limited, a company now exposed as the financial front of a sophisticated con syndicate.

According to investigators, the elaborate plot was executed in April 2024, when the American victim was lured into Nairobi with the promise of purchasing 3,370 kilograms of gold. The deal appeared airtight—documents were signed at Gate 53, Chalbi Drive in Lavington, and a fake smelting demonstration was staged to make the transaction appear authentic.

To complete the illusion, Ochanda’s company, Toureg Insurance Brokers, was introduced as the firm tasked with insuring the gold. The victim was convinced to pay an extra USD 226,012 in “insurance fees,” money that was wired directly into Toureg’s bank account—where Ochanda himself was the signatory.

But the gold never existed. After the funds were cleared, the so-called “deal” vanished, leaving the investor stranded. Detectives later established that Toureg Insurance Brokers had no capacity, license, or track record to handle such transactions. Instead, it was a shell created to siphon funds from unsuspecting victims.

Today, the director of the fraudulent firm finally landed in police custody. “This is a major breakthrough in exposing gold scams that continue to soil Kenya’s reputation abroad,” one senior detective said.

Ochanda remains in custody and will face charges at the Milimani Law Courts on Monday, August 18, 2025.

For years, Nairobi has been the epicenter of international gold fraud, with criminal syndicates masquerading as brokers, insurers, and government officials. Ochanda’s arrest is being seen as a warning shot to other scammers hiding behind fake companies and glossy office doors.

As the case unfolds, the spotlight now shifts to Toureg Insurance Brokers Limited—a company at the center of this multimillion-dollar scandal. How many more victims have been fleeced through its fake operations?