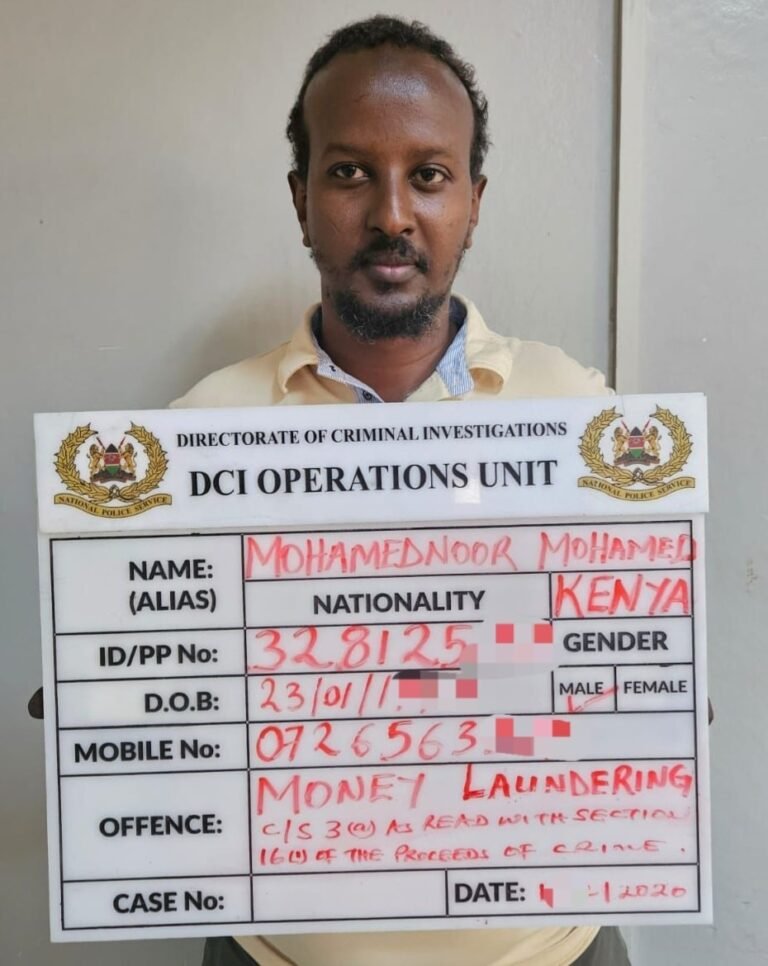

A significant embezzlement scandal has engulfed OKI General Trading Ltd, with allegations that its former director, Honey Khatwani, misappropriated Sh356 million over four years. The alleged theft occurred between January 1, 2020, and June 30, 2024.

Khatwani stands accused of diverting funds that were meant for company operations. The money is said to have disappeared through questionable channels, with no clear record of how it was spent. During this period, the company reportedly faced operational challenges that were never attributed to poor performance, but now appear connected to the alleged missing funds.

The case was brought before court, where the prosecution presented charges against Khatwani for misappropriation. Details shared in court indicate a pattern of financial manipulation and lack of oversight. Internal financial audits reportedly flagged irregularities, but these warnings went unheeded until the matter reached law enforcement.

For many of OKI’s junior employees, the theft has sown distrust. Workers say they noticed delayed payments, cuts in resources, and shrinking benefits while the leadership maintained a veneer of normalcy. At public expense, expenses that should have supported business growth instead seem to have fattened someone’s pockets.

Kenyans follow this sort of scandal with growing concern, especially as it reflects broader issues of corruption in the business sector. In a climate where financial integrity is supposed to matter, such accusations raise urgent questions: Who else in the leadership knew about the misused funds? Why did internal governance mechanisms fail so badly? And will justice be served swiftly?

As the legal process unfolds, observers insist the case must serve as a warning. Companies must strengthen transparency. Boards must demand accountability from directors. And the law must act not only to punish but to deter. Because when millions vanish in secret, trust is what ultimately suffers — and that loss hits all of us.