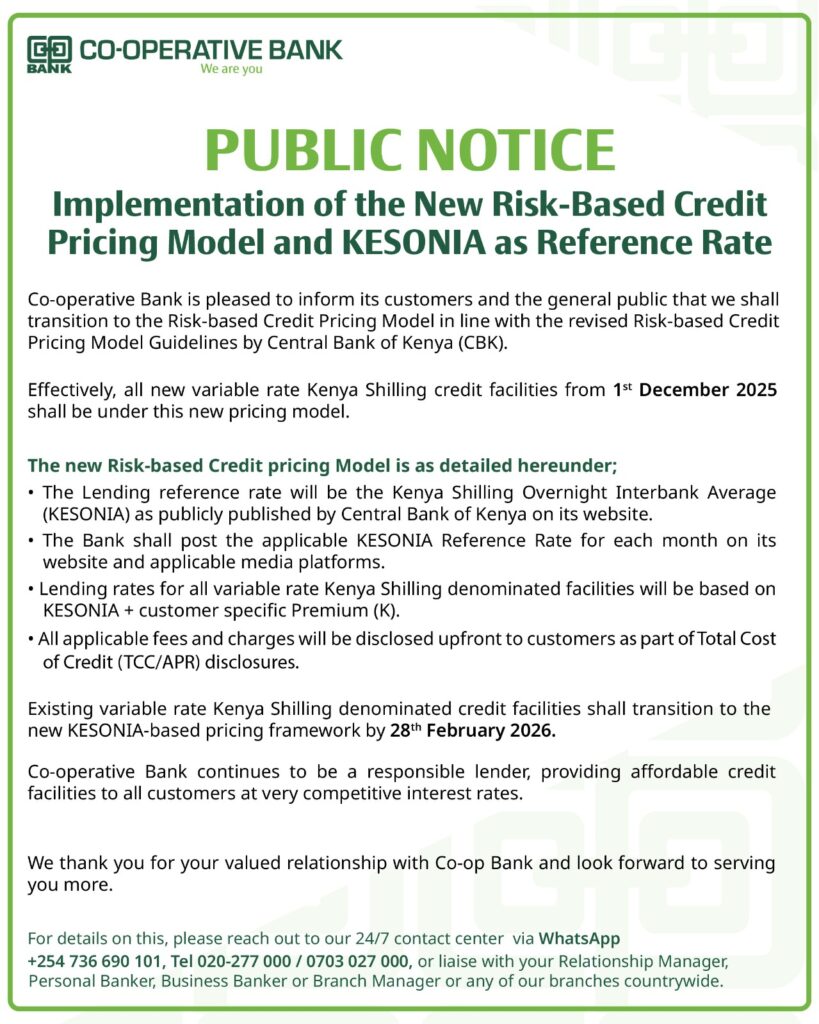

Co-operative Bank of Kenya has announced a major shift in how it prices its credit facilities, confirming it will fully transition to a Risk-Based Credit Pricing Model starting 1st December 2025, in line with revised guidelines issued by the Central Bank of Kenya (CBK).

In a public notice released on Monday, the lender said all new variable-rate Kenya Shilling credit facilities issued from December will adopt the new pricing structure, which is designed to more accurately reflect the risk profile of individual borrowers.

The move aligns with CBK’s sector-wide directive requiring banks to adopt transparent, risk-sensitive lending frameworks that ensure borrowers are priced fairly based on their creditworthiness.

KESONIA to Serve as New Reference Rate

Under the updated model, the bank will use the Kenya Shilling Overnight Interbank Average (KESONIA) as the lending reference rate. This benchmark is publicly published by CBK and is expected to replace the previously used Central Bank Rate (CBR) as the core pricing anchor for variable-rate loans.

Co-op Bank stated that monthly KESONIA reference rates will be posted on its website and shared through relevant media platforms to enhance transparency for borrowers.

How the New Model Will Work

According to the bank, lending rates for all applicable Kenya Shilling facilities will now be structured as:

KESONIA + Customer-Specific Premium (K)

This means each borrower’s interest rate will depend on both the prevailing KESONIA rate and an additional premium determined by their individual risk assessment. The bank has also committed to disclosing all applicable fees and charges upfront as part of Total Cost of Credit requirements.

Existing Loans to Transition by Early 2026

Co-op Bank clarified that existing variable-rate Kenya Shilling loans will not be immediately affected. Those facilities will gradually be moved to the new pricing model by 28th February 2026, giving customers time to adjust and receive updated loan information.

Bank Reaffirms Commitment to Competitive Pricing

In the notice, Co-op Bank reiterated its commitment to offering affordable lending while maintaining responsible credit practices. The bank assured customers that it will continue to provide financing at competitive interest rates despite the shift to a risk-based framework.

“We thank you for your valued relationship with Co-op Bank and look forward to serving you more,” the statement read.