Gavel And Scales Of Justice and National flag of Kenya

Wambugu Muchiri & Company Advocates is now at the centre of a widening criminal investigation after allegations emerged that the firm attempted to defraud an insurance company by filing compensation claims supported by forged police and medical documents.

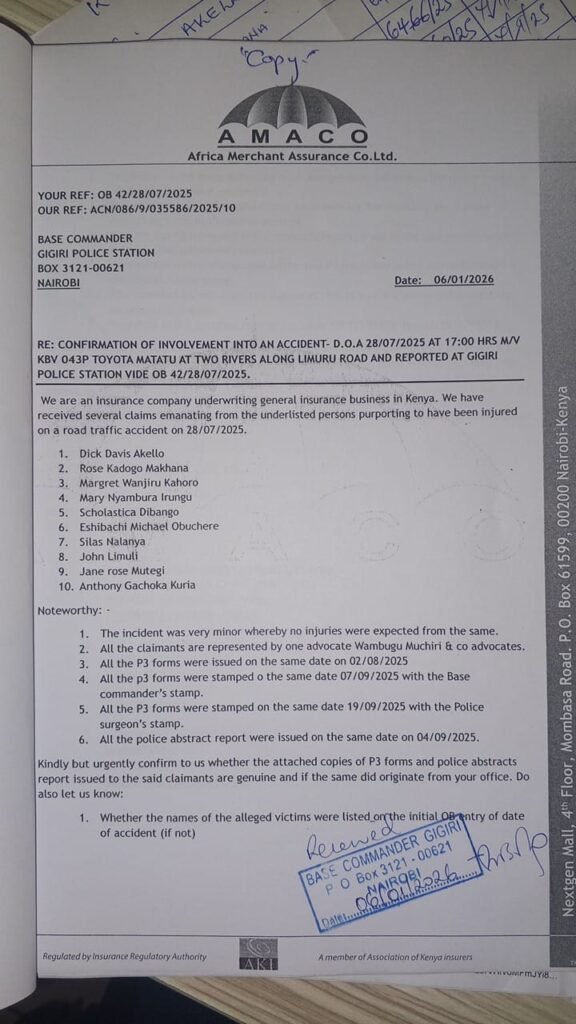

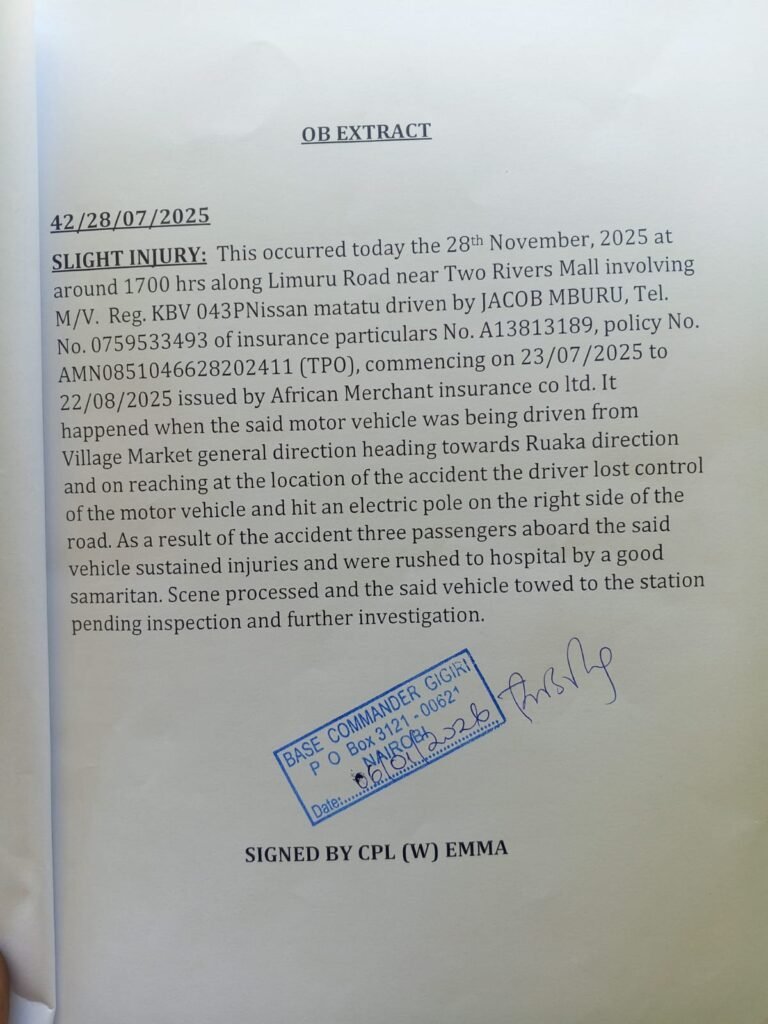

The case, now in the hands of the Directorate of Criminal Investigations, stems from a road accident reported to have occurred on July 28, 2025 along Limuru Road, involving a Toyota matatu with registration KBV 043P. Police records show the crash was minor, with only three passengers sustaining injuries.

However, investigators say the claims later submitted through the law firm painted a very different picture, alleging that 10 passengers had suffered varying degrees of injuries. The names listed in the claims include Dick Davis Akello, Rose Kadogo Makhana, Margret Wanjiku Kahoro, Mary Nyambura Irungu, Scholastica Dibango, Eshibachi Michael Obuchere, Silas Nalanya, John Limuli, Jane Rose Mutegi, and Antony Gachoka Kuria.

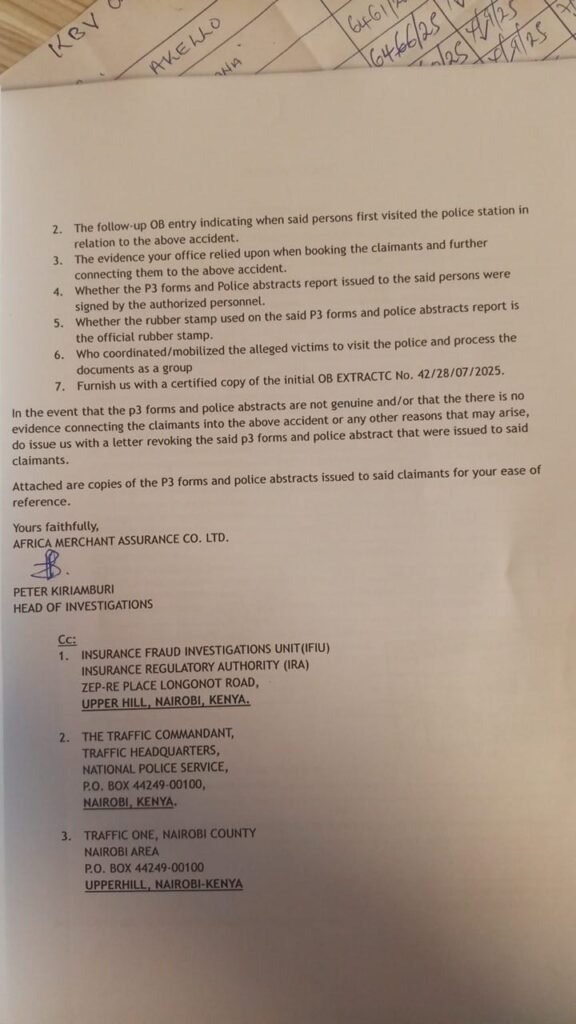

The matter escalated after AMACO Insurance Company Ltd, while reviewing the compensation demands, allegedly discovered irregularities suggesting that the claims may have been built on falsified documents. According to information available, AMACO’s internal verification raised suspicion that the police abstracts and P3 forms presented in support of the claims were not genuine.

On January 6, 2026, AMACO formally wrote to the Base Commander at Gigiri Police Station, seeking confirmation on the authenticity of the documents that had been presented by individuals associated with the claims.

The response came the following day, and it landed like a bombshell.

In a letter dated January 7, 2026, the Gigiri Traffic Base Commander reportedly stated that the police abstract and P3 form submitted for verification were forged, and did not originate from Gigiri Traffic Base. The commander further said the documents were not traceable to official records and that the station disassociated itself from them and any claims arising from them.

That statement immediately weakened the claims and placed the spotlight on the individuals behind the documentation.

AMACO subsequently escalated the matter to the DCI, triggering an investigation into alleged insurance fraud, forgery, and the use of false documents. Sources indicate that a lawyer linked to the claims was arrested but later released under unclear circumstances, a development that has raised concerns about whether powerful influence could be at play.

The unfolding case is now fuelling public debate around the increasing sophistication of insurance fraud syndicates, where minor accidents can allegedly be turned into major compensation schemes through inflated victim lists and falsified paperwork.

Investigators are also understood to be reviewing additional files and records, as more cases of similar nature may be linked to the same broader network. If that line of inquiry expands, the scandal could expose how certain compensation claims are manufactured and pushed through legal channels, potentially costing insurers millions.

The allegations have sparked renewed calls for stronger verification systems between insurance firms, medical facilities and police stations, as well as tougher action against those found to be forging P3 forms and police abstracts to support fraudulent claims.

For the legal profession, the case has also raised uncomfortable questions, as advocates are expected to serve justice, not weaponise the court process to pursue claims based on questionable documentation. The DCI is expected to pursue further action as investigations continue.