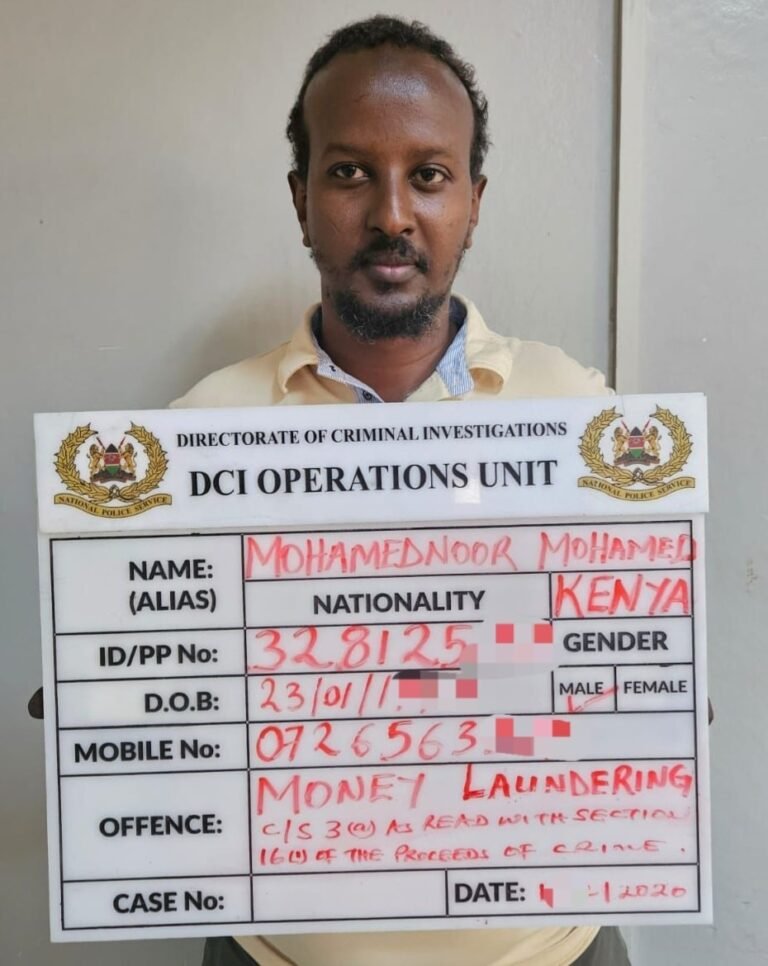

Inside Nairobi City Hall’s Shadowy Money Laundering Network

A disturbing money laundering scandal unfolding at Nairobi City Hall has exposed a dangerous loophole in Kenya’s public finance and corporate oversight systems — one that allowed phantom foreign nationals with no traceable identity to access public funds.

At the centre of the investigation are undocumented foreign directors whose nationality is officially listed as “not applicable”, a classification that raises serious legal and security concerns.

In simple terms, Nairobi County was transacting with people who officially do not exist.

The Phantom Directors

Records linked to the probe show that Mitesh Shah Mahendrakumar and Jagat Shah Mahendrakumar are listed as directors and shareholders of AR Pharmaceutical Limited, one of at least nine companies currently under investigation.

Despite holding senior control positions in a company that allegedly received public money, their nationality, country of origin, and legal immigration status remain unclear.

In corporate and immigration law, this is not a minor clerical error.

Every company director in Kenya is required to have:

-

A verifiable nationality

-

A valid identification document

-

A traceable legal presence

Yet in this case, official records list the directors’ nationality as “not applicable”, effectively rendering them stateless on paper.

Investigators say this anomaly is a major red flag.

Why Phantom Identities Matter

Anti-money laundering experts say phantom identities are a known tool in financial crime.

When individuals lack verifiable nationality:

-

Tracing money becomes difficult

-

Asset freezing is delayed or blocked

-

Criminal accountability collapses

-

Extradition becomes nearly impossible

In essence, money can move fast while justice moves nowhere.

According to investigators, this setup created a perfect laundering channel where funds could be received, transferred, and concealed with minimal traceability.

The Web of Ghost Companies

AR Pharmaceutical Limited is not alone.

At least nine companies are now under scrutiny for allegedly participating in irregular procurement deals at Nairobi City Hall.

The companies are suspected to have:

-

Received payments for inflated contracts

-

Been paid for services never rendered

-

Operated as pass-through entities for laundering public funds

These are classic indicators of ghost company operations, where firms exist mainly to receive and move money rather than deliver goods or services.

Inside City Hall: Collusion Allegations

Investigators believe the scheme could not have succeeded without internal collusion.

Procurement officers, finance officials, and approving authorities are suspected to have:

-

Failed to conduct proper due diligence

-

Ignored red flags in company registration documents

-

Approved payments despite glaring inconsistencies

The question now being asked is whether this was negligence or deliberate facilitation.

Either way, public money was exposed.

Regulatory Failure on Multiple Fronts

The scandal has exposed weaknesses across several institutions:

-

The Registrar of Companies, for approving firms with unverifiable directors

-

Immigration authorities, for failing to flag undocumented foreign nationals

-

County procurement systems, for allowing ghost entities to win contracts

-

Financial oversight bodies, for failing to detect suspicious payment patterns

This was not a single-system failure.

It was a systemic breakdown.

An International Dimension

The presence of undocumented foreign nationals introduces a cross-border risk.

If funds were moved outside Kenya, recovery becomes significantly harder.

Investigators fear that the phantom status of the directors may have been deliberately engineered to allow money to disappear beyond Kenyan jurisdiction.

This raises the stakes from corruption to transnational financial crime.

Public Trust on the Line

For Nairobi residents, the scandal strikes at the heart of public trust.

City Hall is entrusted with:

-

Healthcare

-

Infrastructure

-

Sanitation

-

Public services

Every shilling lost to ghost contracts is a shilling stolen from essential services.

Kenyans are now demanding answers:

-

Who approved these companies?

-

Who verified the directors?

-

Who authorised the payments?

-

How many other phantom entities are still active?

Bigger Than One Scandal

Investigators warn this case may be just the tip of the iceberg.

If phantom directors could penetrate Nairobi City Hall, the same loopholes may exist across other counties and state agencies.

The scandal exposes a dangerous truth.

Kenya’s systems can be gamed.

And when identity disappears, accountability follows.

This was not ordinary corruption.

It was a well-engineered shadow operation, built on phantom identities, ghost companies, weak oversight, and insider collusion.

Until director identities, procurement systems, and financial controls are tightened, public money will remain vulnerable.

The unanswered question is no longer whether the system was abused.

It is how long it has been happening — and who else is involved.